By Landon Cole, Contributing Writer

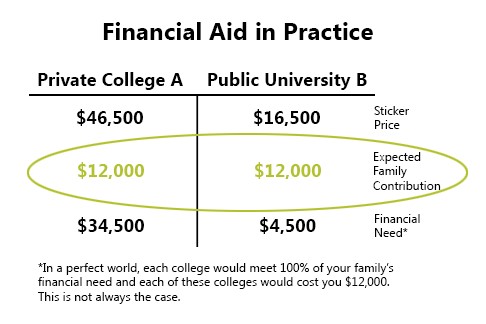

Like many college students, I fall into a category that can make the financial aid process difficult. The Federal Student Aid office grossly overestimates my family’s contribution to my education when, in reality, I paid out-of-pocket for my associate’s degree from a community college, and I’m relying on loans to pay for my bachelor’s degree. The EFC (estimated family contribution) is calculated using parents’ combined household income to estimate a student’s eligibility for federal direct subsidized and unsubsidized student loans. These EFCs are often tied up in mortgages and car payments and are not accurate estimates of parents’ ability or willingness to pay for their child’s education. In my case, because the Department of Education estimates that my parents should pay for my college—and because that is far from my reality—I’m only eligible to take out a quarter of my annual tuition in federal student loans.

But I’m not alone; Southern Illinois University of Carbondale graduate Matthew Tasso experienced the same problem when his EFC disqualified him from receiving any federal subsidized or unsubsidized loans. This is despite the fact that Matthew was not receiving any financial help from his family. “I wasn’t even living with my family at the time,” Matthew explained, “but my dad’s income was still used to estimate my eligibility.” Because of this inaccurate estimate, Matthew had no other option than to take out personal loans through his bank and another private lender. According to Matthew, his loans have subprime interest rates and much less lenient payment plans than federal direct student loans.

Kim Clark from US News details the Department of Education’s unrealistic and outdated expectations with regard to family contribution toward secondary education: “The federal government expects parents to contribute at least 22 (and, for wealthier families, as much as 47) cents of every dollar above an arbitrarily low family budget. For example, a single working mother would be expected to start contributing for every dollar she earns above about $30,000 a year. That means a mom who makes about $50,000 a year could be expected to ‘contribute’ more than $3,000 a year to her student’s college expenses.”

And after living expenses like rent, transportation and food are accounted for, the Economic Policy Institute’s “Basic Family Budget Calculator,” shows that—in an example like the one listed above—there often isn’t $300 left at the end of the year, let alone $3,000.

With such an ineffective system available to them, universities have had to subsidize student tuition with athletic and academic scholarships. However, this is only a Band-Aid solution and quickens the inflation of tuition. It’s essentially the university printing out money and handing it over to students.

The scope of this issue is far larger than McKendree University, and I urge anyone reading this article to write an email to your state representative. Visit this site at https://www.house.gov/representatives/find-your-representative and simply enter your ZIP code to find your representative and their email address. Our nation’s leaders are tasked with providing an effective system by which we can judge the financial need of our students, and we have to hold them accountable.

Excellent piece! I recall as an undergraduate student having a bewildered financial aid counselor scoff at the fact I was making payments rather than my parent. Many assumptions made about parent contribution.

Excellent article!